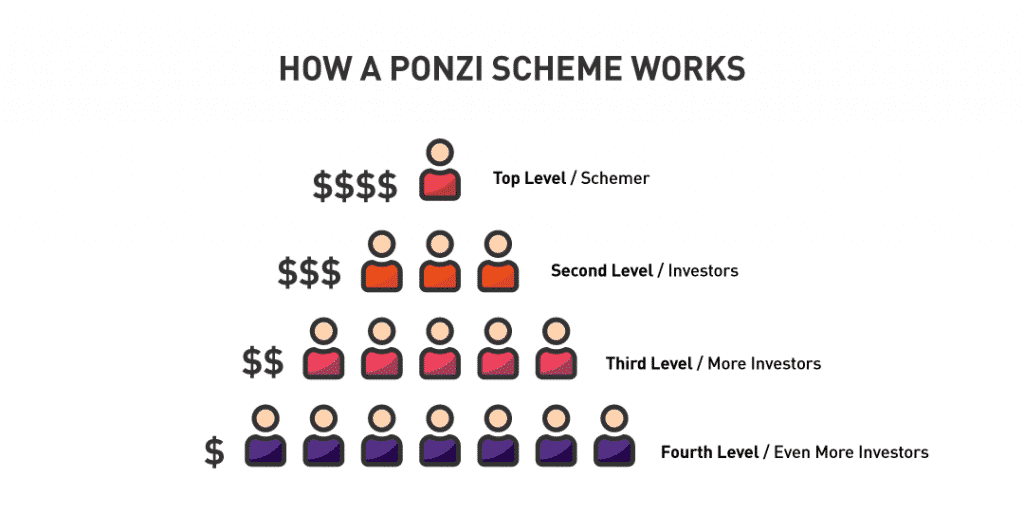

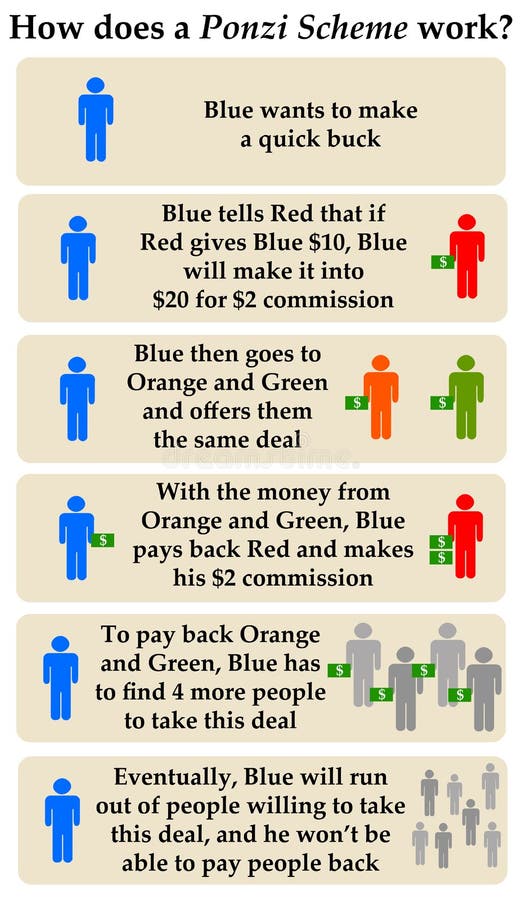

A ponzi scheme is thought about a deceptive financial investment program. It includes utilizing payments gathered from brand-new investors to pay off the earlier investors. The organizers of Ponzi schemes typically promise to invest the cash they gather to generate supernormal earnings with little to no threat. Nevertheless, in the genuine sense, the scammers don't truly plan to invest the cash. https://businessdeccan.com/tyler-tysdal-throws-light-on-the-importance-of-diversification-in-the-business-world/

When the new entrants invest, the cash is gathered and used to pay the original financiers as "returns."However, a Ponzi scheme is not the like a pyramid scheme. With a Ponzi scheme, financiers are made to think that they are making returns from their financial investments. On the other hand, individuals in a pyramid scheme understand that the only method they can make revenues is by recruiting more people to the scheme.

Warning of Ponzi Schemes, A lot of Ponzi plans featured some typical qualities such as:1. Promise of high returns with very little threat, In the real life, every financial investment one makes brings with it some degree of danger. In fact, financial investments that provide high returns normally carry more risk. So, if somebody offers a financial investment with high returns and few dangers, it is likely to be a too-good-to-be-true offer.

Where Does The Name Ponzi Come From

2. Overly constant returns, Investments experience variations all the time. For instance, if one invests in the shares of an offered company, there are times when the share price will increase, and other times it will reduce. That stated, financiers ought to always be hesitant of investments that generate high returns regularly regardless of the fluctuating market conditions.

Unregistered financial investments, Before rushing to buy a scheme, it is very important to confirm whether the investment firm is registered with U.S. Securities and Exchange Commission (SEC)Securities and Exchange Commission (SEC) or state regulators. If it's registered, then an investor can access details regarding the company to figure out whether it's legitimate.

Unlicensed sellers, According to federal and state law, one ought to possess a particular license or be registered with a managing body. Most Ponzi schemes deal with unlicensed people and companies. 5. Deceptive, sophisticated techniques, One ought to avoid financial investments that consist of treatments that are too complicated to comprehend. History of the Ponzi Scheme, The scheme got its name from one Charles Ponzi, a scammer who fooled countless investors in 1919.

Ponzi Scheme Warning Signs

Back in the day, the postal service used international reply vouchers, which made it possible for a sender to pre-purchase postage and incorporate it in their correspondence. The recipient would then exchange the voucher for a priority airmail postage stamp at their home post office. Due to the fluctuations in postage costs, it wasn't uncommon to discover that stamps were pricier in one nation than another.

He exchanged the coupons for stamps, which were more expensive than what the discount coupon was originally purchased for. The stamps were then cost a greater price to make a profit. This kind of trade is called arbitrage, and it's not unlawful. Nevertheless, at some point, Ponzi ended up being greedy.

Given his success in the postage stamp scheme, nobody questioned his intentions. Unfortunately, Ponzi never really invested the cash, he just plowed it back into the scheme by paying off some of the financiers. The scheme went on until 1920 when the Securities Exchange Business was investigated. How to Protect Yourself from Ponzi Plans, In the exact same way that an investor investigates a company whose stock he's about to purchase, a person must investigate anyone who helps him manage his finances.

Ponzi Scheme Also Known As

Also, before buying any scheme, one need to ask for the business's monetary records to verify whether they are legit. Key Takeaways, A Ponzi scheme is merely an illegal investment. Named after Charles Ponzi, who was a scammer in the 1920s, the scheme promises constant and high returns, yet allegedly with very little threat.

This type of scams is called after its developer, Charles Ponzi of Boston, Massachusetts. In the early 1900s, Ponzi introduced a scheme that ensured investors a half return on their investment in postal vouchers. Although he was able to pay his initial backers, the scheme liquified when he was unable to pay later financiers.

What Is a Ponzi Scheme? A Ponzi scheme is a deceptive investing rip-off promising high rates of return with little risk to financiers. A Ponzi scheme is a deceitful investing rip-off which generates returns for earlier investors with money taken from later financiers. This resembles a pyramid scheme in that both are based upon utilizing new financiers' funds to pay the earlier backers.

Ponzi Scheme Chattanooga

When this flow goes out, the scheme breaks down. Origins of the Ponzi Scheme The term "Ponzi Scheme" was coined after a swindler named Charles Ponzi in 1920. However, the first recorded circumstances of this sort of financial investment fraud can be traced back to the mid-to-late 1800s, and were managed by Adele Spitzeder in Germany and Sarah Howe in the United States.

Charles Ponzi's initial scheme in 1919 was concentrated on the US Postal Service. The postal service, at that time, had industrialized worldwide reply discount coupons that permitted a sender to pre-purchase postage and include it in their correspondence. The receiver would take the coupon to a local post workplace and exchange it for the top priority airmail postage stamps needed to send out a reply.

The scheme lasted until August of 1920 when The Boston Post started investigating the Securities Exchange Company. As a result of the paper's investigation, Ponzi was jailed by federal authorities on August 12, 1920, and charged with a number of counts of mail fraud. Ponzi Scheme Warning The concept of the Ponzi scheme did not end in 1920.

Ponzi Scheme How Long

Ty Tysdal News on on Social Media

Kind of financial scams 1920 image of Charles Ponzi, the namesake of the scheme, while still working as a business person in his office in Boston A Ponzi scheme (, Italian:) is a form of fraud that lures financiers and pays earnings to earlier financiers with funds from more current investors.

No comments:

Post a Comment